Like many sectors of the economy, the energy industry has faced new challenges as a result of the COVID-19 pandemic. Shifts in demand, production capacity, and distribution networks related to the virus have led to imbalances in supply and demand. Businesses and consumers who rely on petroleum and its byproducts are now confronting shortages in supply—and seeing higher prices as a result.

While the current conditions are unique and likely temporary, concerns about oil shortages are nothing new. Since before the energy crisis of the 1970s, experts have warned of “peak oil”—the point at which oil production from available reserves reaches maximum capacity and begins to diminish. But despite predictions that oil production is poised for decline, advances in geological understanding and technology like horizontal drilling and fracking have actually expanded production in recent years.

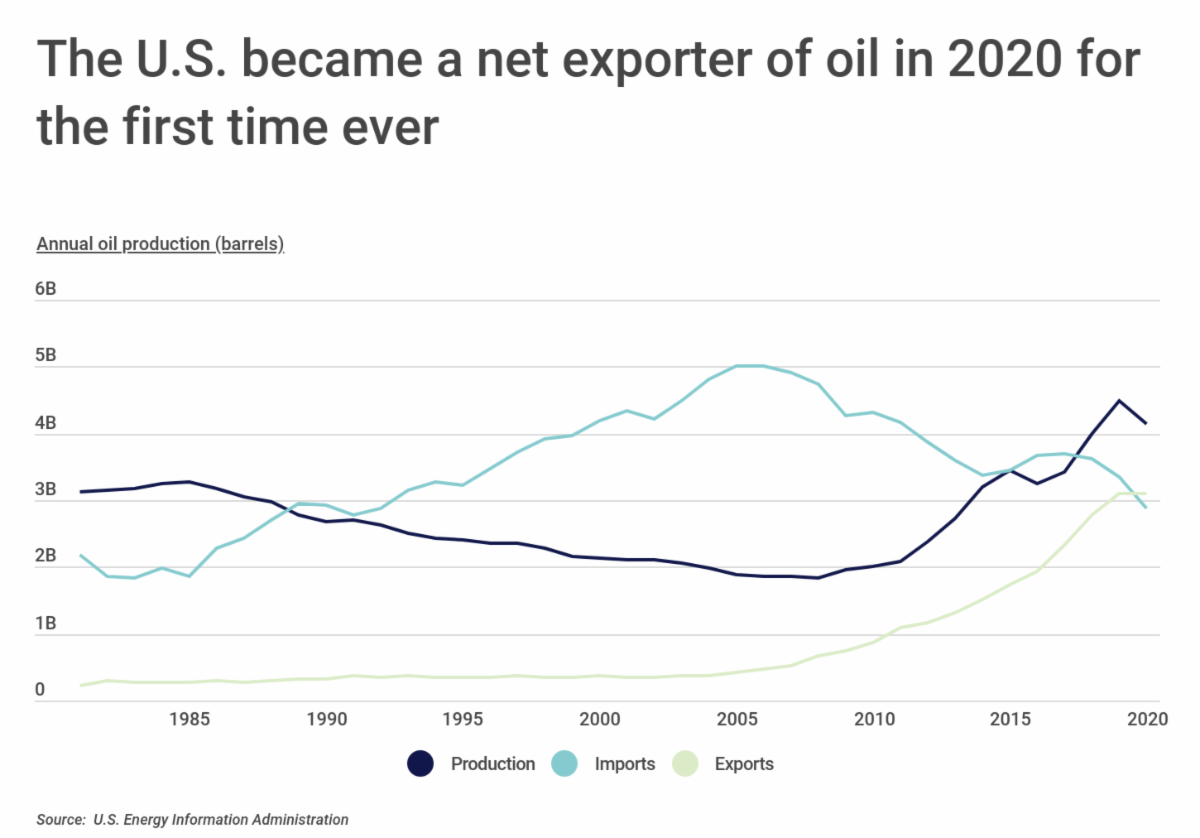

These new techniques were first widely adopted in the early to mid-2000s, and since then, the oil business in the U.S. has transformed. From the early 1980s to around 2008, U.S. oil production fell from 3.1 billion barrels to 1.8 billion per year while oil imports more than doubled from 2.1 billion to around 5 billion. Since then, imports have fallen sharply while production and exports have grown. Oil production today is over 4 billion barrels annually, and in 2020, the U.S. became a net exporter of oil for the first time.

|

One important metric for capturing the growth in the oil industry in the U.S. is proved reserves. The U.S. Energy Information Administration defines proved reserves as the estimated volume of hydrocarbon resources that are recoverable under current economic and operating conditions, which can shift based on new discoveries, shifts in production capacity, or improved techniques and technologies. Proved reserves in the U.S. had peaked historically at 39 billion barrels in the early 1970s before falling by more than half, to 19 billion, in 2008. In the years since, proved reserves have spiked to above 44 billion barrels as new extraction techniques have taken hold.

|

Some states have seen greater effects from the recent boom in oil production than others. Texas has seen a 51.7% increase in the size of its proved oil reserves over the last five years, further cementing its place as the top oil state in the U.S. With more than 18.6 billion barrels of proved oil reserves, Texas now has more than three times the total of the next-highest state, North Dakota (5.9 billion). But some other states have also been rapidly climbing up the list of major oil-producing states, with states like New Mexico (134.1% increase over the last five years) and Oklahoma (64.9%) seeing dramatic growth in the size of their reserves due to improvements in production.

The most recent EIA data available shows crude oil proved reserves in Colorado totaled 1.4B barrels in 2019, following a 17.8% increase since 2014. Out of all U.S. states with at least one million barrels, Colorado has the 7th most crude oil proved reserves. Here is a summary of the data for Colorado:

- Crude oil proved reserves (million barrels): 1,414

- 5-year change in proved reserves (percent): +17.8%

- 5-year change in proved reserves (million barrels): +214

- Number of operating refineries: 2

For reference, here are the statistics for the entire United States:

- Crude oil proved reserves (million barrels): 44,191

- 5-year change in proved reserves (percent): +21.5%

- 5-year change in proved reserves (million barrels): +7,806

- Number of operating refineries: 124

Leave a Reply